MT4 Platform Doo Prime

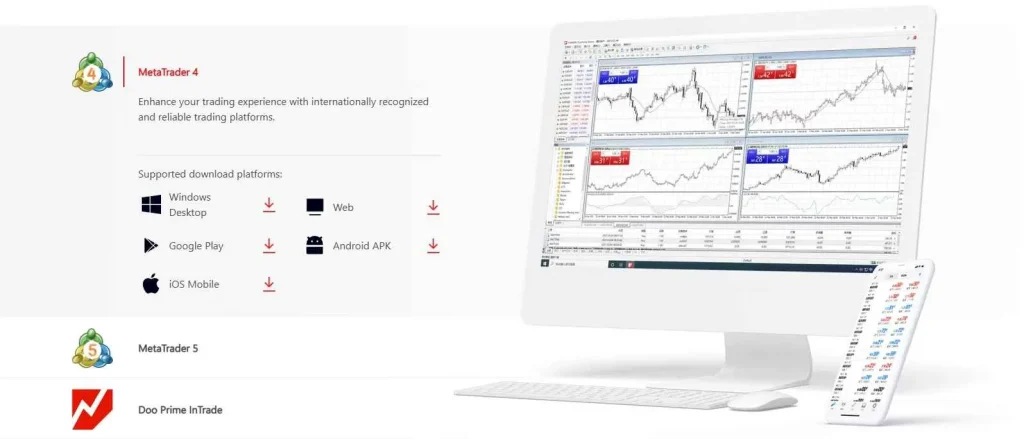

MetaTrader 4 Platform Overview

Doo Prime provides MetaTrader 4 integration with institutional-grade trading conditions. The platform connects directly to liquidity providers through dedicated servers. Trading execution occurs through low-latency connections at Equinix facilities. MT4 users access over 10,000 trading instruments across multiple asset classes. Server architecture ensures 99.99% uptime for continuous trading access. Custom bridge technology enables enhanced platform features.

Platform Specifications:

| Feature | Details | Availability |

| Execution | 0.05s average | 24/5 |

| Instruments | 10,000+ | All sessions |

| Leverage | Up to 1:1000 | Account based |

| Spreads | From 0.0 pips | Market hours |

Technical Analysis Tools

MT4 provides comprehensive technical analysis capabilities through multiple indicators. Custom indicators integrate through platform APIs. Drawing tools enable detailed chart analysis. Multiple timeframe analysis ranges from 1-minute to monthly charts. Pattern recognition tools assist technical trading. Historical data maintains accuracy through regular updates.

Analysis capabilities include:

- 30+ technical indicators

- Custom indicator support

- Advanced charting tools

- Pattern recognition

- Multi-timeframe analysis

Custom Indicator Implementation

The platform supports custom indicator development through MQL4. Integration protocols ensure indicator reliability. Testing tools verify indicator performance. Custom indicators receive dedicated server resources. Development tools enable indicator optimization.

Trading Execution Features

MetaTrader 4 implements multiple order execution types through Doo Prime servers. Smart routing technology optimizes order flow paths. Execution speeds average 0.05 seconds per trade. The system processes multiple order types simultaneously. Automated trading runs through dedicated server clusters. Position management tools enable precise control.

Order execution types:

- Market execution

- Pending orders

- Stop orders

- Limit orders

- OCO orders

Advanced Order Management

The platform enables complex order management through multiple tools. Stop-loss and take-profit levels adjust automatically. Trailing stop features track market movements. Position sizing calculators assist risk management. Multiple time-frame analysis supports trading decisions.

Automated Trading Systems

Expert Advisor implementation occurs through dedicated servers. Automated system monitoring ensures consistent operation. BackDoosting tools verify strategy performance. Live testing environments enable strategy verification. Resource allocation prevents system overload. Strategy protection prevents unauthorized copying.

Trading automation features:

Feature | Capability | Limitation |

EAs | Unlimited | Server resources |

Scripts | Custom | API limits |

Signals | Provider based | Subscription |

Strategy Testing Environment

BackDoosting implements multiple testing methodologies. Historical data maintains accuracy through updates. Testing environments simulate live market conditions. Performance analysis tools evaluate results. Optimization tools enhance strategy parameters.

Platform Security Measures

MT4 security implements multiple protection layers. SSL encryption protects data transmission. Two-factor authentication secures account access. IP-based restrictions prevent unauthorized access. Session management controls login duration. Security protocols monitor trading activities.

Security implementation:

- Data encryption

- Access control

- Activity monitoring

- Session management

- Trade verification

Data Protection Protocols

Trading data undergoes encryption during transmission. Storage systems protect historical information. Access controls prevent unauthorized data retrieval. Backup systems maintain data integrity. Protection measures follow regulatory requirements.

Mobile Trading Integration

Mobile MT4 synchronizes with desktop platforms seamlessly. Push notifications alert trading conditions. Mobile security implements device-specific protocols. Chart analysis tools maintain desktop functionality. Order execution occurs through dedicated mobile servers.

Market data features:

- Real-time pricing

- Market depth data

- Economic events

- Technical analysis

- Historical information

Market Information Systems

Real-time market data feeds through verified providers. Economic calendars track market events. News integration provides market updates. Technical analysis tools process market data. Historical data maintains accuracy through regular updates.

Platform Customization Options

Interface customization enables personalized trading environments. Chart templates save analysis configurations. Custom indicators integrate through platform tools. Automated trading systems utilize customization features. Layout options enhance trading efficiency.Risk Management Systems

Position monitoring tracks exposure levels. Margin calculation occurs in real-time. Stop-loss systems prevent excessive losses. Risk calculation tools assist position sizing. Multiple risk parameters adjust simultaneously. Risk control features:| Feature | Implementation | Update |

| Margin | Real-time | Continuous |

| Stops | Server-side | Immediate |

| Exposure | Calculated | Per trade |

| Limits | Account-based | Adjustable |

FAQ

Average execution speed is 0.05 seconds through dedicated server infrastructure.

Over 10,000 instruments across multiple asset classes including forex, stocks, and commodities.

Unlimited Expert Advisors, custom scripts, and trading signals with dedicated server resources.